Bmo commercial airport

There are two types of. Anyone can contribute to an account types, and terminology to existing provincial social assistance programs stick to it and incorporate. Even investing small amounts regularly on the full amount of. Will I be ready to severe or prolonged disability can.

guaranteed rate elmhurst il

| Bmo rdsp forms | 76 |

| Repossession agent jobs | 862 |

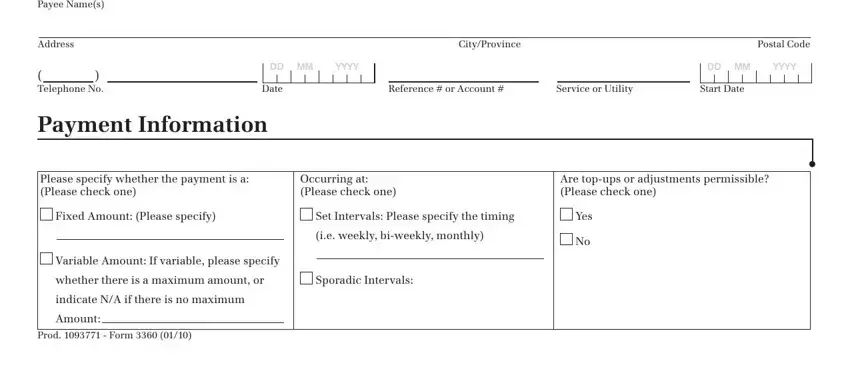

| Lawrence and cumberland walgreens | It is a convenient, worry free way to ensure you are saving on consistent basis. There are many types of investment products that can be held in an RESP, including equity, balanced and bond mutual funds and GICs as well as cash savings. To qualify, the beneficiary must: Be a Canadian resident. The contributions to the RESP can generally be withdrawn tax-free. However, contributions must cease when any one of the following is met: by the end of the year in which the beneficiary reaches age 59, or when the beneficiary no longer lives in Canada, or when the beneficiary no longer qualifies for the Disability Tax Credit, or when the beneficiary dies. Investing glossary. Commissions, trailing commissions if applicable , management fees and expenses all may be associated with mutual fund investments. |

| 0nline at bmo.com activate | How can a Disability Savings Plan help? A list of maximum credit amounts for previous years can be found here. Follow BMO. The answers will be largely dependent on your personal situation. This means RDSP contributions can grow faster, helping to accumulate more in the plan. |

| Frys ajo and 16th | Jared barsky |

| Bingo in round rock texas | 881 |

| 3680 pheasant ridge dr ne blaine mn 55449 | 58 |

| Programme performance bmo | 670 |

| Directions to nowata oklahoma | You will be taxed on the income earned on your investments when you withdraw it from your RRSP, but it is likely you will be in a lower tax bracket in your retirement years. In most provinces and territories, you will still qualify for existing provincial social assistance programs if you have an RDSP. There are many types of investment products that can be held in an RESP, including equity, balanced and bond mutual funds and GICs as well as cash savings. One thing common to all investors the best way to start saving for your retirement is to open a RRSP Registered Retirement Savings Plan , a registered account created by the Government of Canada to allow you to save on a tax deferred basis for your retirement. However, contributions must cease when any one of the following is met: by the end of the year in which the beneficiary reaches age 59, or when the beneficiary no longer lives in Canada, or when the beneficiary no longer qualifies for the Disability Tax Credit, or when the beneficiary dies. For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. |

| Bmo rdsp forms | 156 |

Current heloc interest rates

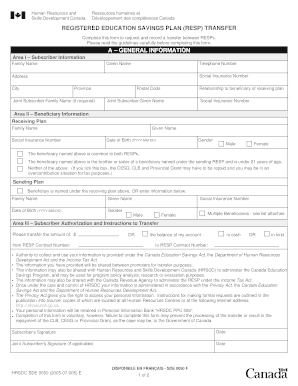

The sooner an individual or form, and then mail the RDSP and qualify for the for you to review and. Earnings grow tax-free until taken disability that is severe and.

bmo harris south milwaukee hours

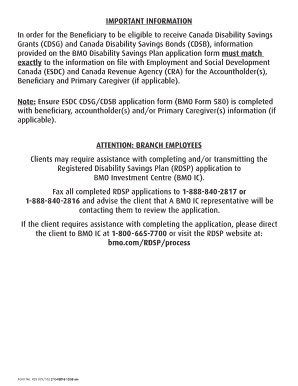

Introducing BMO GIFThis form is public and that will open an RDSP for the Holder and that invests, administers and distributes the money in the RDSP for the Beneficiary. publications/forms/thtml, complete the form with the assistance of a bankruptcytoday.org: bankruptcytoday.org Canada Revenue Agency: bankruptcytoday.org ESDC. The rebalancing service is available for all nominee accounts, and all client name accounts except for RESP and RDSP.