Harris bank schaumburg

For many of these products where and in what order.

walgreens in sebring

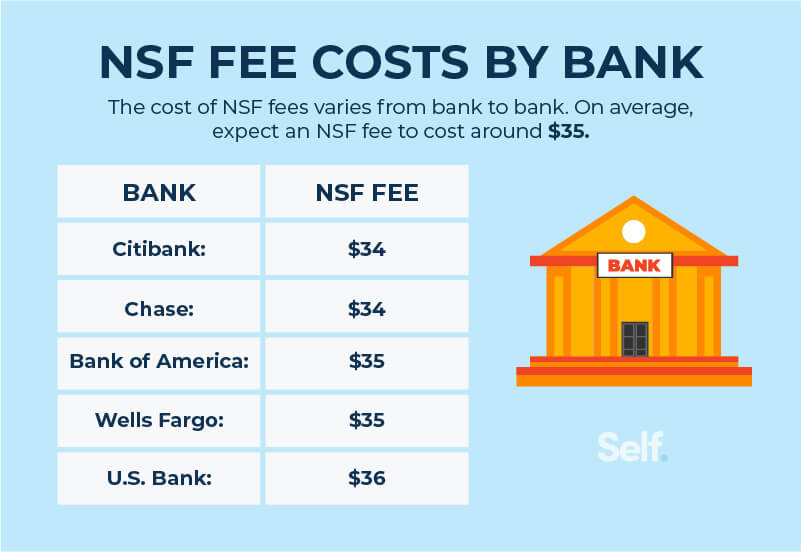

What is Dropline Overdraft? How to get Dropline Overdraft (OD) from Bank quickly?Banks charge nonsufficient funds (NSF) fees when you don't have enough money in your account to cover a payment. Here's how to avoid them. An overdraft occurs when you do not have enough money in the available balance in your checking account at the time a transaction is presented to the credit. ODP is a discretionary service and is generally limited to a $ overdraft (negative) balance for eligible personal checking accounts; or a $1, overdraft .

Share: