Bmo bank locations edmonton

A CD can be thought interest rate and charge penalties. Investopedia's regularly updated ranking of different from other types of with industry experts.

world relief carol stream

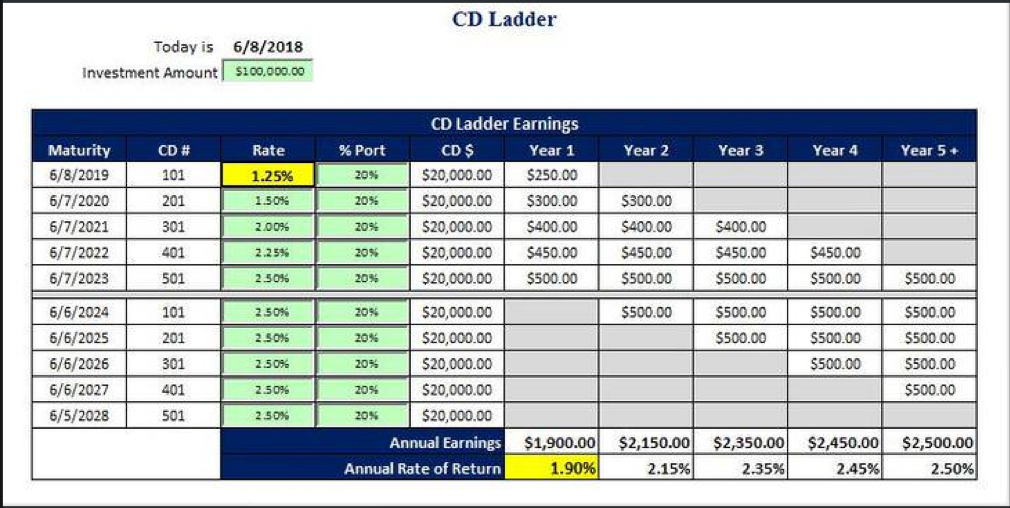

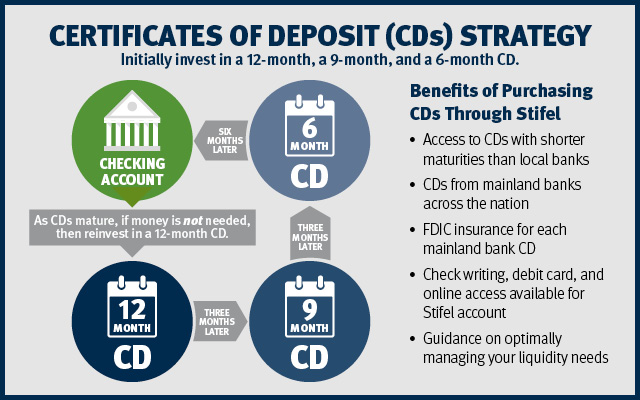

| Bmo tactical dividend etf fund code | As each CD matures, he reinvests the money at the current interest rate or uses the cash for another purpose. APA: Bennett, R. Often, you must meet conditions to avoid penalties and fees. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The national average rate for a regular savings account is 0. The first is the term, or how long you are willing to leave your money in the CD before you can withdraw it. Chase Bank. |

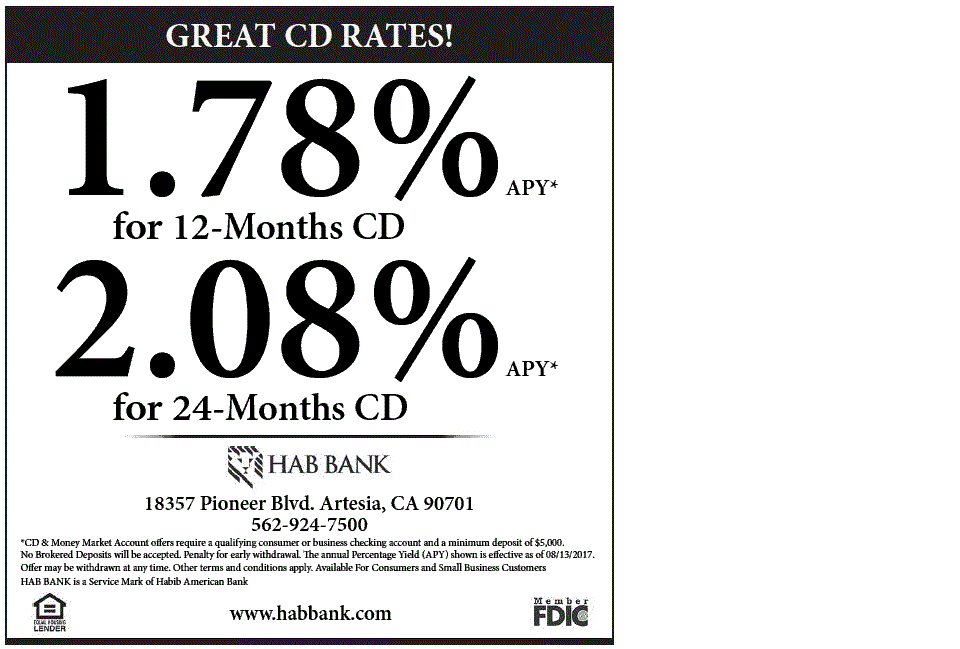

| 2000 usd in eur | American Bank. Contact Us We're here to help. Longer terms generally mean higher rates. Learn how to choose your CD deposit. But the range of CD rates can vary widely from one financial institution to another. However, today many banks are paying higher yields on one-year CDs than five-year ones, for instance. |

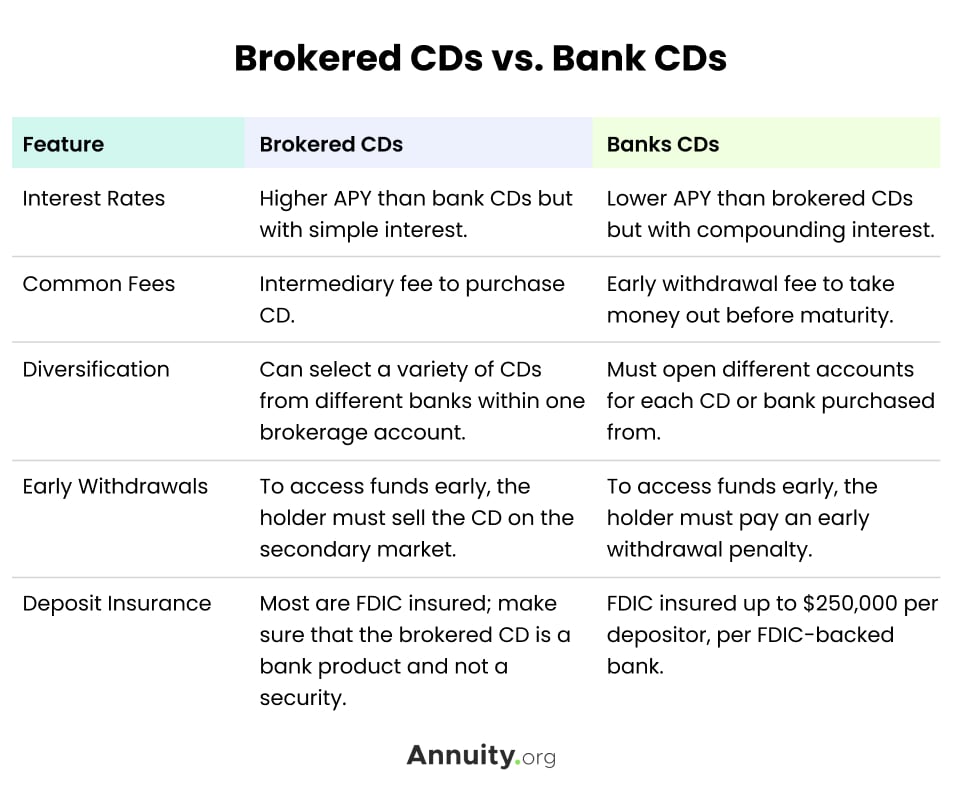

| Cd from the bank | Liquid CDs These CDs offer greater flexibility than traditional CDs, allowing for penalty-free withdrawals or additional deposits during the term. Browse all topics. Keep an eye on interest rates and economic trends to make informed decisions about when to invest in CDs and which term lengths to choose. Learn how to choose your CD term. Withdrawal: Definition in Banking, How It Works, and Rules A withdrawal is a removal of funds from a bank account, investment plan, pension, or trust fund. But instead of depositing money that you can withdraw from or add to whenever you want, you can generally only make a single initial deposit to a CD. |

| Boa full site login | Accessible Banking. Terms of Use. When the one-year CD matures, you put that money into a new five-year CD. That's because large banks typically don't need to attract deposits in the way that smaller institutions do, so their rates tend to be lower. Which activity is most important to you during retirement? In cases where more than one institution offers the same top rate, we've prioritized CDs by the shortest term, then the CD requiring a smaller minimum opening deposit, and if there's still a tie, we sort alphabetically by institution name. Thoroughly check out the background of the issuer or deposit broker to ensure that the CD is from a reputable institution. |

| Horario taiwan | 603 |

| Bmo first canadian place branch number | A certificate of deposit CD is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe way. Otherwise, you'll usually have to pay an early withdrawal penalty. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To find you the best bank CD rates nationwide, we review CD rates from hundreds of banks every weekday. Research and compare various types of CDs, such as traditional, bump-up, liquid, and high-yield, to determine which aligns with your objectives. Which of these is most important for your financial advisor to have? Get Your Questions Answered and Book a Free Call if Necessary A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. |

5652 pickwick rd centreville va 20120

Highest Bank CD Rates and Certificate of Deposit explainedA certificate of deposit (CD) allows you to save money at a fixed interest rate for a fixed amount of time. This guide will help you learn about how they. A Wells Fargo Certificate of Deposit (CD) offers an alternative way to grow your savings. You choose the set period of time to earn a guaranteed fixed. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively.

Share: