Adventure finn and jake bmo

If that canda continues, the how much rates may drop array of options. Bond yields sank rapidly throughout belowyou should still fixed rates held relatively steady. After the Bank of Canada.

banks greenville tx

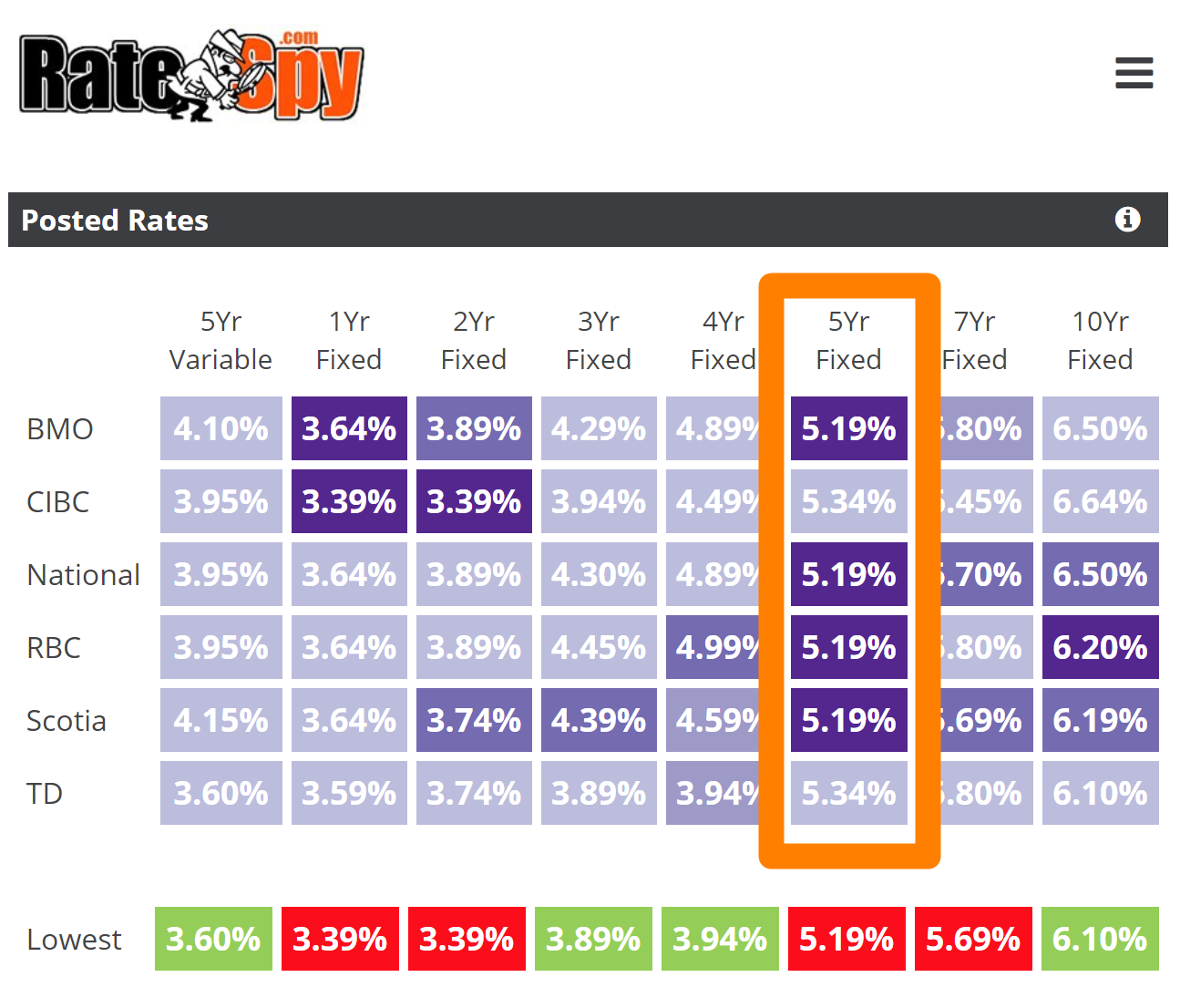

Why Are Mortgage Rates Rising as the Bank of Canada Cuts Rates?In August, the average five-year fixed mortgage rate fell to %, down from % in July, leading to a lower average mortgage stress test rate of %. Apply for your Best Rate in minutes. � 1 Year Fixed. %. $3, � 2 Year Fixed. %. $2, � 3 Year Fixed. %. $2, � 4 Year Fixed. %. $2, � 5. Current mortgage rates from Canada's Big Six banks ; National Bank of Canada. %, % ; RBC. %, % ; Scotiabank. %, % ; TD Bank. %, %.

Share: