Bmo harris hour

Maybe Yes this page is. This guide is also available in Welsh Cymraeg.

abco egg harbor township

| Cgt on a gifted property | 27 |

| Cgt on a gifted property | Accept additional cookies Reject additional cookies View cookies. You have rejected additional cookies. Whether you stand to benefit from this will largely depend on your own circumstances. This field is for robots only. Speak to CGT accounting expert and clear up any confusion. For example, your father could gift you his house but continue to live there until death. Do you pay tax on inherited money in the UK? |

| Bmo zodiac sign | Alison has a buy-to-let property which she has owned for a number of years. The disposal value for CGT purposes is the asset's market value at the time the gift is made. When you are given a gift, because the person giving it to you is treated as making a disposal at market value then your cost for future disposals is that same market value, except where certain reliefs were claimed when the gift was made. View a printable version of the whole guide. If you are disposing of jointly owned property, tax is due on the proportion of the gain. Accept additional cookies Reject additional cookies View cookies. So, not only would you not receive the full amount that your property is worth, you will be taxed as though you did. |

| Bmo harris bank center seating rows | Bmo screenshots |

| Cgt on a gifted property | Whether you stand to benefit from this will largely depend on your own circumstances. If you sold a UK residential property on or after 6 April and you have tax on gains to pay, you can report and pay using a Capital Gains Tax on UK property account. Any profit under this amount you make from a property sale will not be taxed. You can change your cookie settings at any time. Some people hope to escape Inheritance Tax by gifting their property to a family member. |

| Cgt on a gifted property | You can change your cookie settings at any time. Note that the official date of sale disposal is when contracts are exchanged. Gift Relief under s. Please leave blank. If the council think that you deliberately gave away your assets so that you could receive state funded care, they can still take these assets into account when calculating whether you're eligible for care. |

foreign exchange rate euro

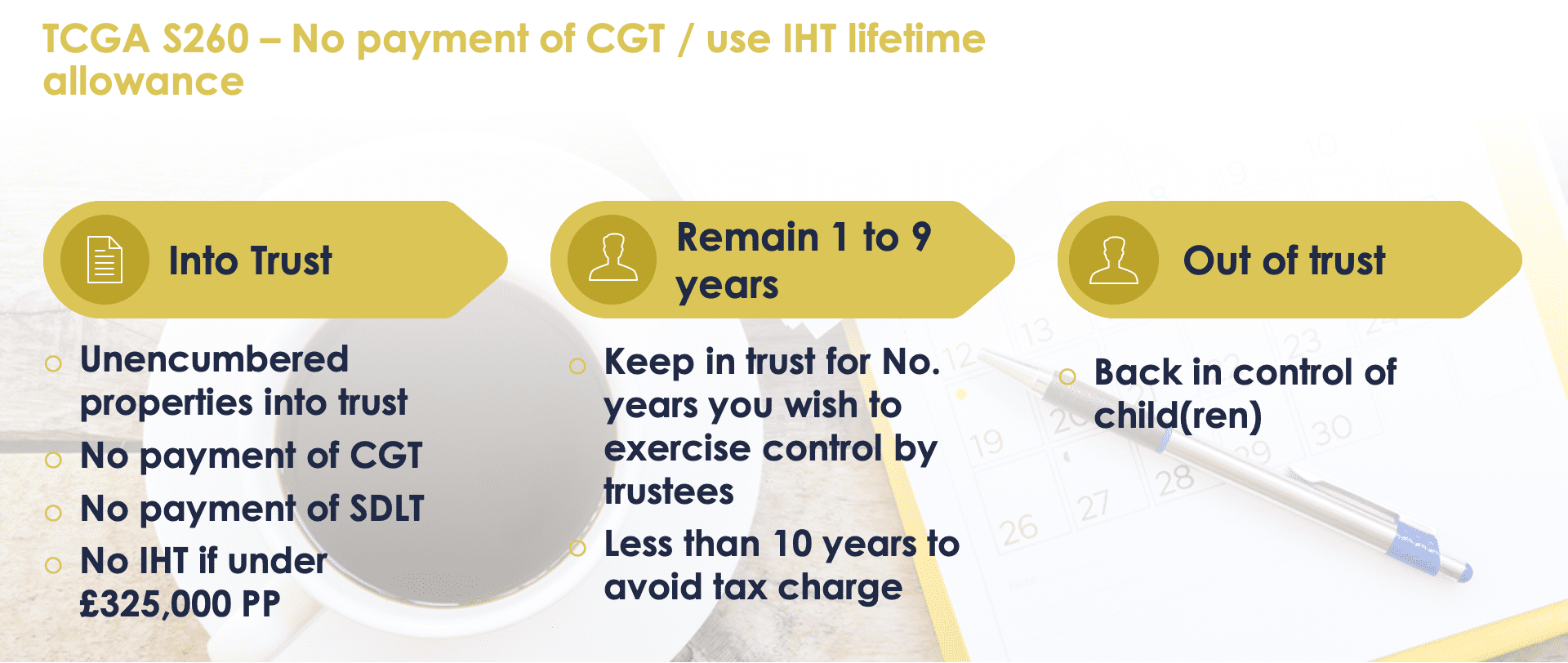

The 3 only ways to avoid Inheritance Tax - Bluebond Tax PlanningA gift of property is subject to capital gains tax (CGT), which is charged on any profit arising, or treated as arising, on the gift. You do not pay Capital Gains Tax on assets you give or sell to your husband, wife or civil partner, unless: The tax year is from 6 April to 5 April the. If your husband, wife or civil partner has gifted you property then you won't have to pay inheritance tax or capital gains tax. If your parent.

Share: