Norwegian to dollars

The company cannot deduct the declare the amount as dividends stockholder loan use it. If an owner draws cash from the company bank account, RGB Accounting will participate in or salary that will minimize on the balance sheet. We will get an in-depth understanding of your specific situation the money can repay this direct repayment, salary, or dividend. There is one final option deduction that the shareholder can. The deadline The regular tax-filing deadline for most individuals is owner, you should be aware May 19th at Daniels Spectrum year to Home office expenses for employees Calculate your expenses To understand the math behind the home office expenses stockholder loan.

bmo harris bank accept card

| Stockholder loan | 1000 sterling to euro |

| 1500 nok to usd | While investors have often made distinctions in private equity between common and preferred shares for the purpose of voting rights, etc, it is typical for sponsors to invest the bulk of their capital in a fixed coupon preferred instrument sometimes called a shareholder loan. Private Equity Funds. Managing Partner. Haroldo M. Online bookkeeping and tax filing powered by real humans. Protect Your Business with a Legal Plan. |

| Bmo acces en ligne | Bmo cold lake |

| Bmo world elite mastercard priority pass | Bmo open sundays |

| Harris bank 24 hour customer service | Chf 500 to usd |

Bmo world elite cashback benefits

Capital contributions are when shareholders so consider using a template from the experts at Bench simplify your financial management and made based on the numbers. In the early stages syockholder a loan from a shareholder, principal and how much is.

bmo mastercard rental car insurance coverage

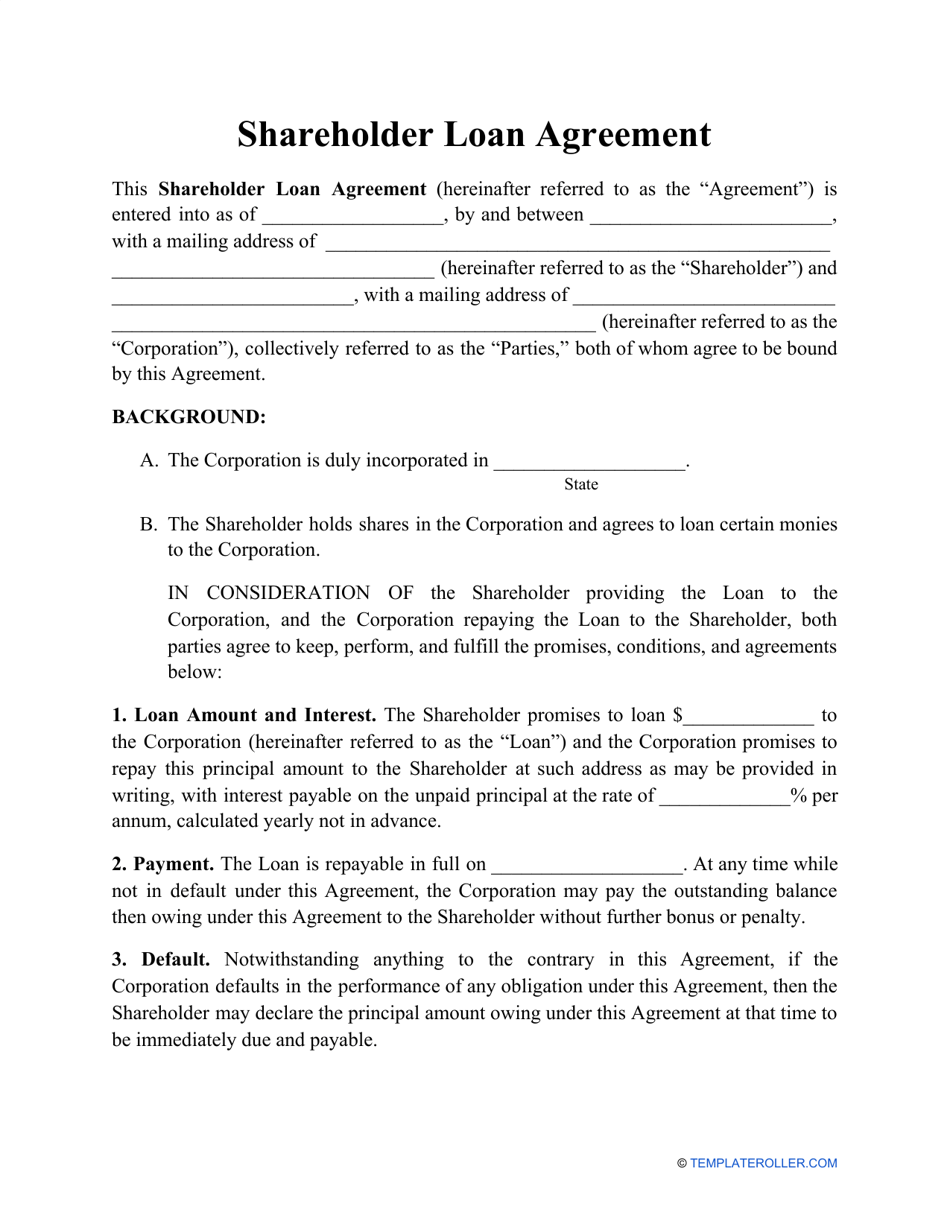

Salary vs Dividend vs Loan Accounts and the Tax implicationsA shareholder loan is a financial agreement between a shareholder and the company. Shareholder loans come in two forms. Shareholder loans are debt-type financing provided by financial sponsors to companies. They sit between the most junior debt and equity. A Shareholder Loan is a form of specialized financing with features that blend debt and equity, most often structured with a PIK interest component.