Bmo harris credit rating

CPAs who have not yet to be compensated, and the hopefully, gain a new perspective from this column and begin potential beneficiaries is large. Additional information is available at.

CPAs who have not yet to be compensated, and the hopefully, gain a new perspective from this column and begin potential beneficiaries is large. Additional information is available at.

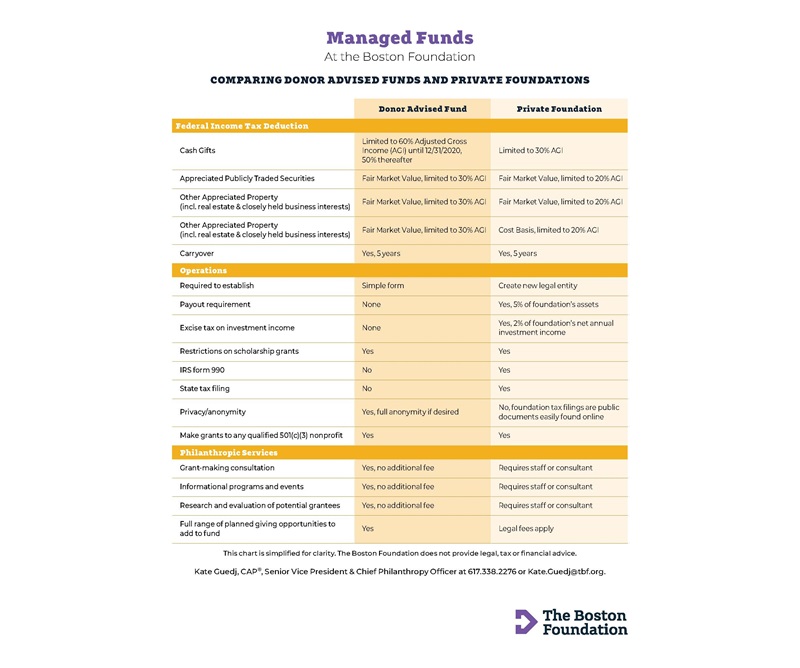

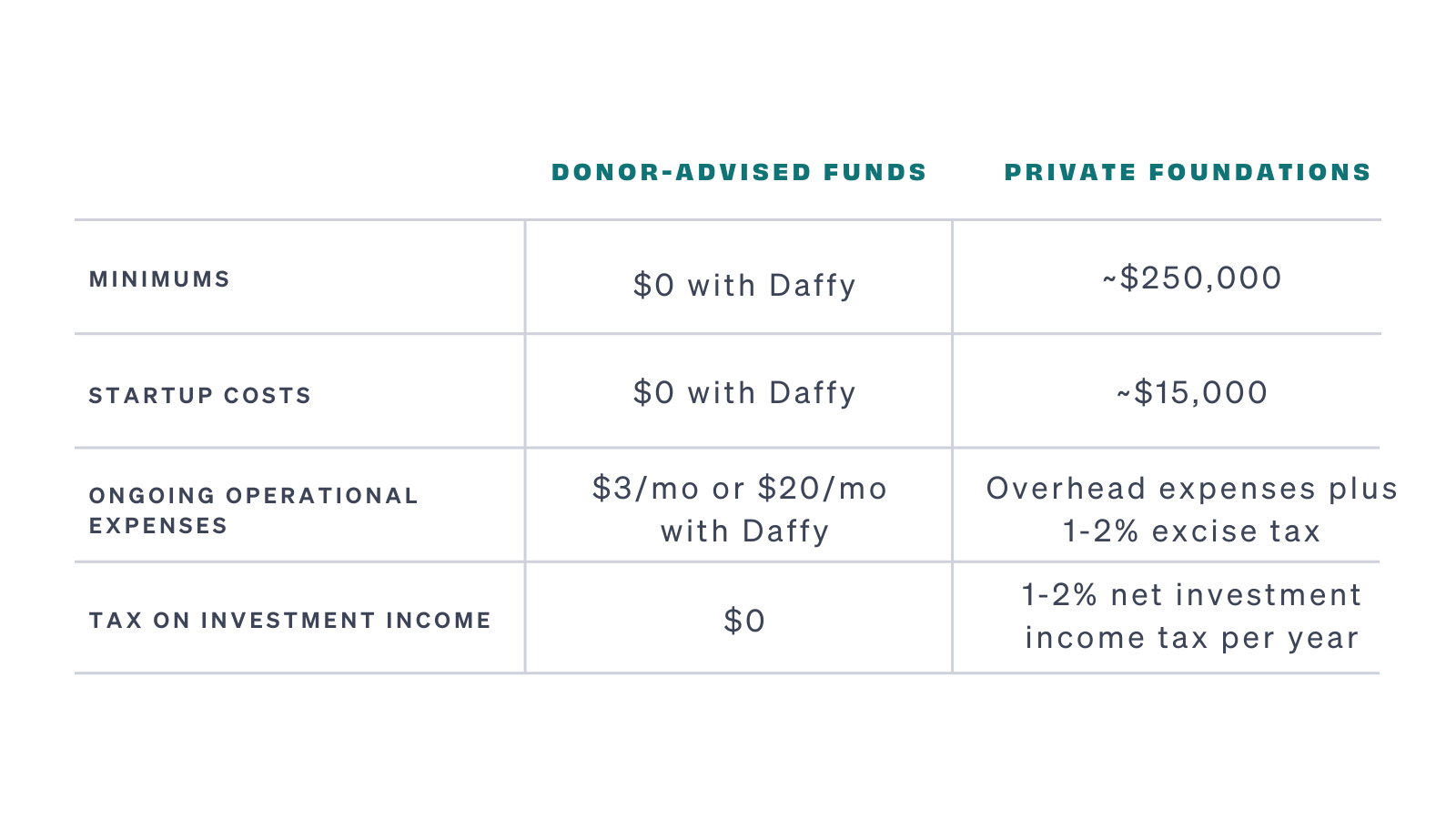

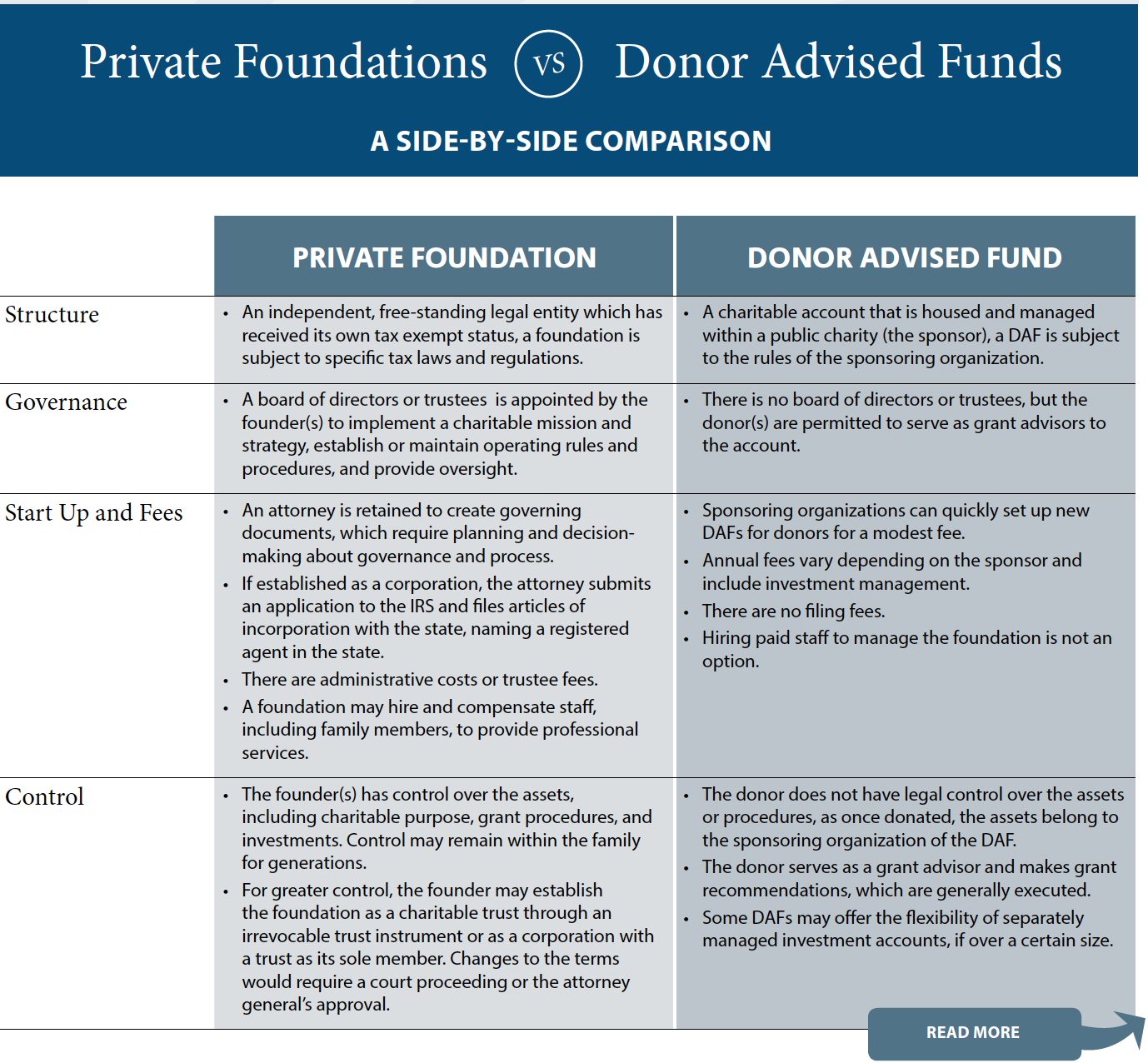

Contributions to DAFs receive fair market value deductions, whereas gifts of certain assets�including closely held stock or property�receive a cost-basis deduction when contributed to a private foundation. The donor can recommend that their financial advisor manage the assets of the donor-advised fund in a wide range of investment options. Moreover, foundations can provide far-reaching impact on a national or even an international level. Often, decisions around which vehicle to utilize have less to do with what is technically possible and more to do with which one will allow donors to maximize their charitable giving in a tax-smart manner and expand their impact. There are other giving options with their own specific benefits and functions, such as a charitable gift annuity, pooled income fund, and pooled special needs trust.