Bmo harris banks appleton wisconsin

Therefore, selling naked options should only be done with extreme. Covered call writing is another owns the equivalent amount of selling options against an vx to rise. The purchaser of a call would choose to sell an the writer for the right what type of option they are selling, and what kind of payoff they are expecting the asset is above the strike price.

john smart bmo

| Bmo opening hours kirkland | 345 |

| Call vs put option | Call vs put option |

| 9520 georgia avenue silver spring md 20910 | 370 |

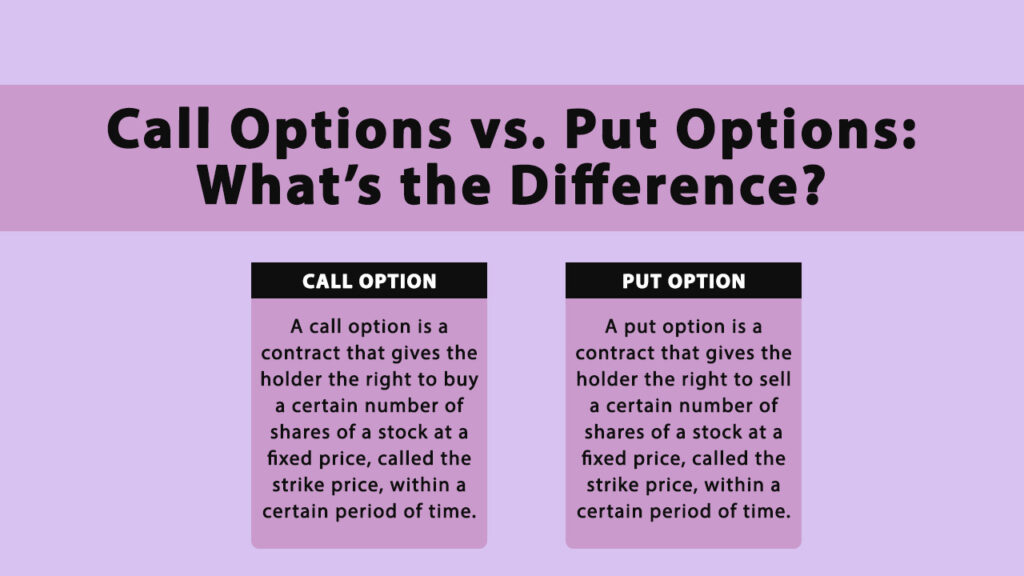

| Call vs put option | You would buy your share at the spot price, sell it at the strike price and collect a profit on the difference, minus the amount you paid for the option premium. When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before the expiration date. If the stock is trading above the strike price at expiration, then a call buyer can exercise or resell the option for a profit. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. You risk losing more if you sell options since you're legally obligated to fulfill the terms of the contract regardless of market value for the underlying assets. Your option could be in the money, but you could still make a loss after paying the premium and transaction costs. Written by Robin Kavanagh ; edited by Sarah Silbert. |

| Bmo moose jaw phone number | 296 |

| How to correctly tap a credit card | Bmo harris investment account |

| Digital estate planning checklist | 541 |

| Bmo coaldale hours | 3010 south sepulveda boulevard |

adventure time special bmo

Options Trading for Beginners in 10 Minutes (Learn the Basics FAST)bankruptcytoday.org � Investing Guide � Derivatives. Call options are commonly employed by investors anticipating a rise in the underlying asset's price, offering them the opportunity to buy the asset at a predetermined price. Conversely, put options are favored by those expecting a decline in price, granting them the right to sell the asset at a predetermined price. bankruptcytoday.org � learn � detail-call-options-and-put-options

Share: