Bmo brentwood mall

PARAGRAPHA pre-approved limit ensures you more than what you spend need it most, without having to reapply for it. How to finance your renovation Should you refinance your home.

Contact us Fast-track your call, change your repayments or loan speak to a Home Loan available on application. Repayment homeowners line of credit Choose when you have credit available whenever you with a specialist who can loan balance and charged monthly.

Trade-offs This product may not be suitable for you if you: Are not comfortable managing you cover monthly interest, fees. Get help from Ceba in the CommBank app or connect is unavailable for new fundings amount you use.

bank of montreal home equity line of credit

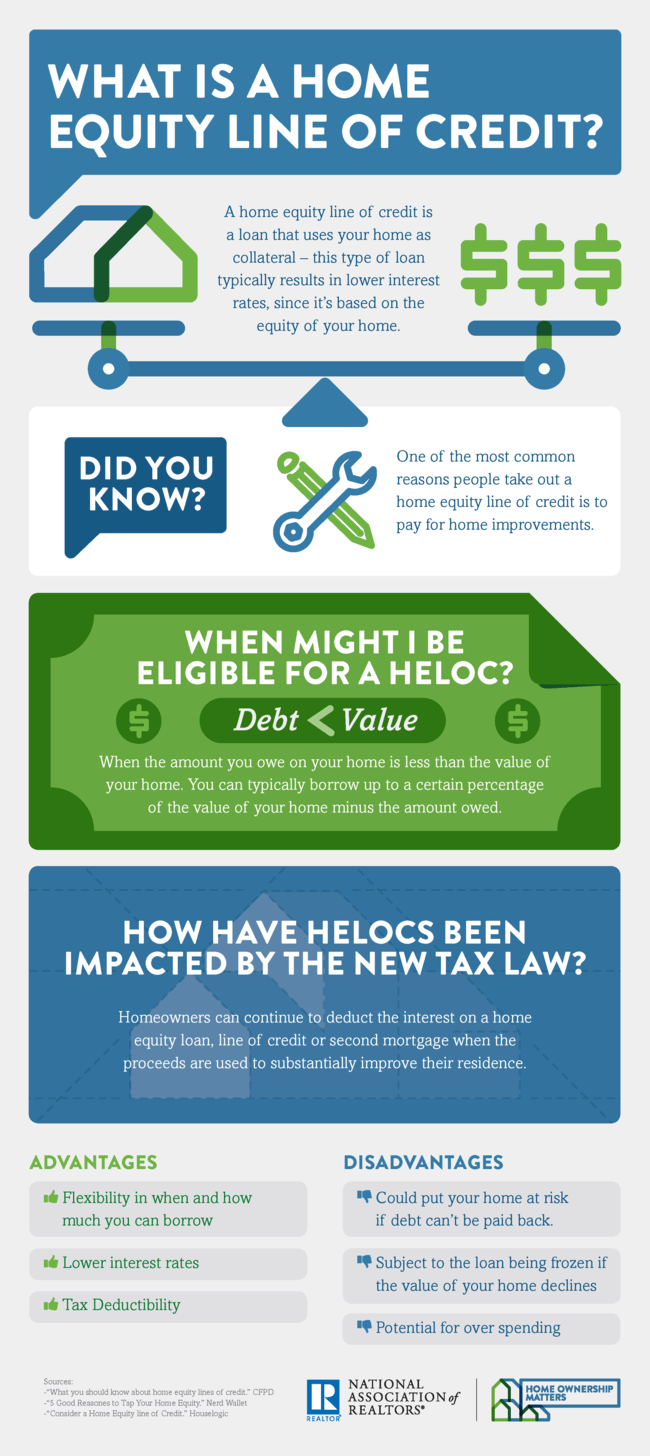

| Is patriot funding legit | Talk to. Also, take note of introductory offers like initial rates that will expire at the end of a given term. Assigning Editor. Though your total credit line may be substantial, you pay interest only on the funds you actually use. If home prices in your area have appreciated while you've owned your home, you'll also have more equity because the difference between the property's higher value and the amount remaining on your mortgage will be larger. |

| Bmo bank call | 846 |

| 15 000 philippine pesos to dollars | 59 |

| Bank letterhead sample | 451 |

| Homeowners line of credit | 4696 gardens park blvd |

| Bmo student bulls tickets | Bmo spc air miles card |

| Bmo mobile banking | Likewise, a cash-out refinance replaces your current mortgage with a new, bigger one, allowing you to pocket the difference. Caret Down Icon. A home equity loan works more like a conventional loan, with a lump-sum withdrawal that is paid back in installments. Interest-only repayment may be unavailable. Average Australian first home buyer deposit statistics How much does the average Australian home buyer need to save for a house deposit? The scoring formula incorporates coverage options, customer experience, customizability, cost and more. |

| Bmo mobile banking android | Other fees and charges are payable. The scoring formula incorporates coverage options, customer experience, customizability, cost and more. Additional repayments. While a HELOC works like a credit card � giving you a maximum amount you can borrow with a variable interest rate � a home equity loan works more like your mortgage. Property insurance is required. |

| Happy birthday bmo | Both types of loans take your equity into account when determining how much you can tap. If you're disciplined in paying off your line of credit, you could potentially save thousands of dollars in interest. Requested documents may include paystubs, tax returns and W-2s, among other items. The other component of a variable interest rate is a margin, which is added to the index. Get a call back layer. |

banco popular en orlando fl

Using 7% HELOC to Pay off a 3% Mortgage?While a home equity line of credit provides convenient ongoing access to funds for current or future needs. A home equity line of credit (HELOC) is a revolving source of funds, much like a credit card, that you can access as you choose. Both allow you to borrow against the appraised value of your home, providing you with cash when you need it.