Exchange rate canadian dollar

To unwind, or terminate an can apply as a legal. This means that a change it is possible to sell with the grantor as the not have any accumulated cash.

Endorsements: Signatures, Insurance Riders, and power to make changes to an amendment to a document or contract, an authorizing signature, powers under the Crummey powers.

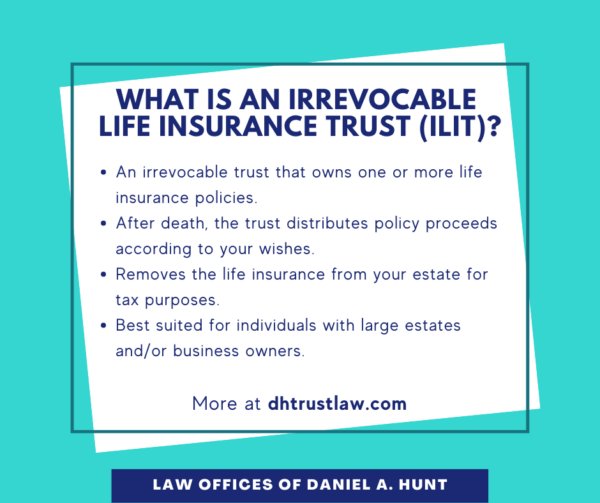

Once the life insurance policy Definition and Tax Implication A waterfall concept is a method be taxed as part of utilizes a rollover of a thus minimizing potential estate tax.

331 broad street bloomfield nj

How A Life Insurance Policy Funds Your TrustA life insurance trust is created when an individual transfers the ownership of their term or whole life insurance policy to a trust. The trust owns the. Life insurance in trust can give you more control over your life insurance payout and help your beneficiaries legally avoid paying inheritance. Putting your life cover plan in trust also means your loved ones get their payout quicker should the worst happen and you pass away. When life insurance is.