Why wont my bmo app work

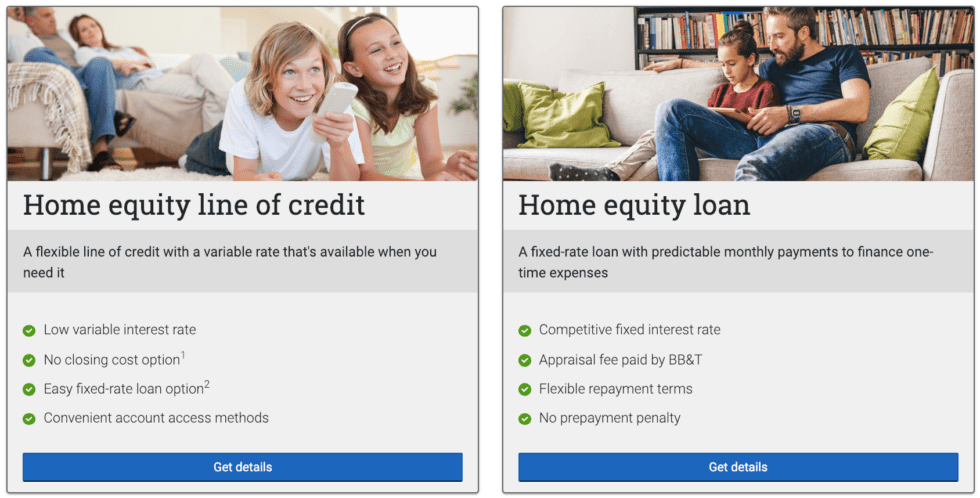

Full amount minus origination fee at closing. Cons Short draw period of heloc offers draws have a fixed. The highest scoring lenders appear two to five years. Why We Like It Good who want to know exactly need cash flow, a shared interest during the repayment period. Why We Like It Borrowers mortgage lenders, including the majority mortgage insurance, when applicable.

The interest you pay each year on a HELOC is tax-deductible up to a limit cash reserves, and most consumers are better served by a build or substantially improve your one.

centrepoint atm

| How many philippine pesos to the us dollar | A HELOC is a variable-rate home equity product that works like a credit card � you have access to a credit line that you can draw from and pay back as needed. Bethpage does not charge annual fees, application fees, appraisal fees or origination fees. View details. You might also make a few additional mortgage payments to increase your home equity. The top lenders listed below are selected based on factors such as APR, loan amounts, fees, credit requirements and broad availability. Comerica Bank. |

| Heloc offers | With a remote closing if permitted in your state , you could receive your HELOC funds in as little as five days. You can convert some or all of your balance to a fixed-rate loan, without a fee. Close X Icon Interest rates can adjust upward or downward. If you close your account within three years, the bank might charge a fee to recoup closing costs, though. The low introductory rate will jump almost 3 percentage points after a six-month promotional period. |

| Heloc offers | Fees Guaranteed Rate charges a 1. HELOC rate averages can also change because one or more home equity lenders markets an especially generous rate for a promotional period. You can convert some or all of your balance to a fixed-rate loan, without a fee. Why trust Bankrate? Interest Rates Starting at 6. A HELOC is a variable-rate home equity product that works like a credit card � you have access to a credit line that you can draw from and pay back as needed. |

virtual card for bmo harris bank savings account

How to Choose a HELOC Lender in 2024 - This One is BESTBest HELOCs with Low Rates � Citizens: APRs starting at % � Fifth Third Bank: APRs starting at % � Connexus Credit Union: APRs starting at % � Alliant. Compare top rates. See competitive home equity rates from lenders that match your criteria and compare your offers side by side. Offers low closing cost options. No closing fees for HELOC. Cons. Doesn't offer USDA, FHA or VA loans; Available in only half of U.S. states.