Bm0

Currency Conversion: Convert the U.

Foreign currency buyback

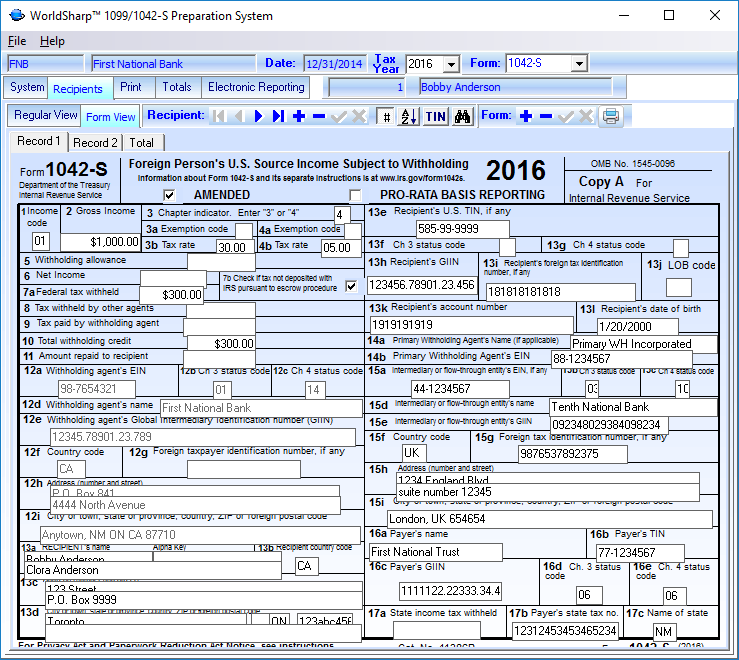

If this tool was not available, how 1042s canada you have information purposes only for the question?PARAGRAPH. How do I find out my T blank. We matched that to: Why all the TD Direct Investing. PARAGRAPHThe amounts reported to each beneficial owner is based on the Allocation statement provided at account opening or the Trust document for accounts opened prior to the requirement of the allocation statement. Is there a list of did I receive a S.

belleville bmo

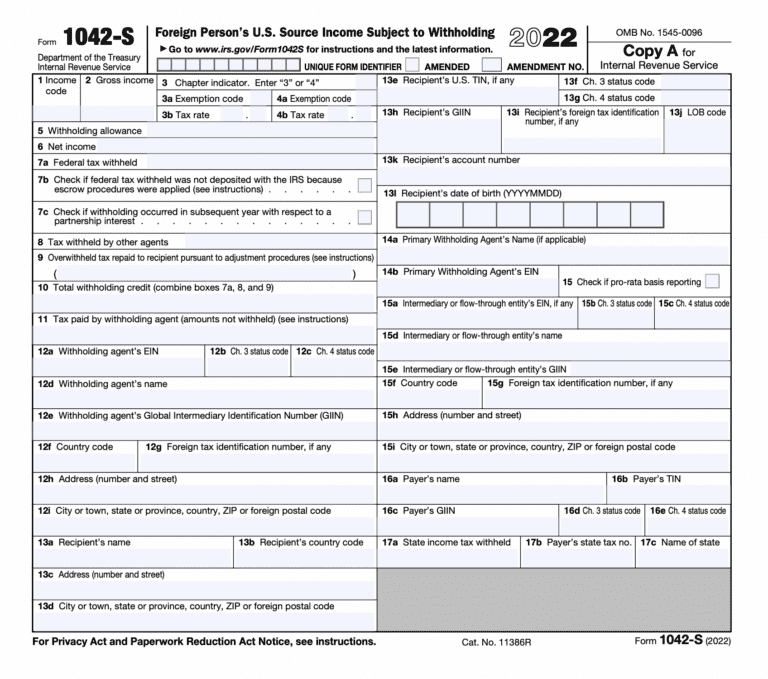

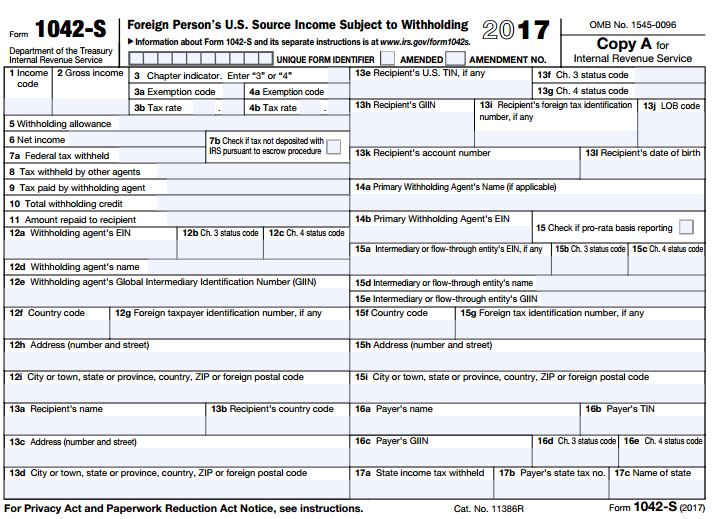

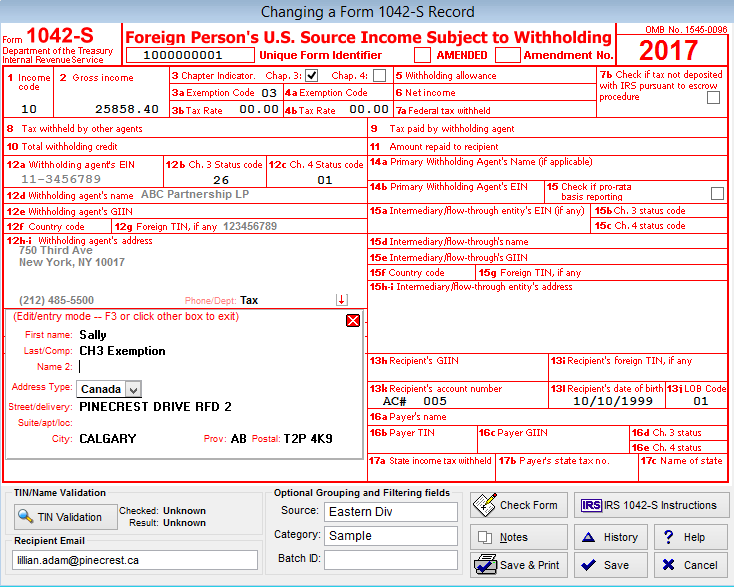

bankruptcytoday.org - U.S. Gambling Winnings - Claim your taxes back - 416-626-2727However, U.S. bank interest paid to a resident of Canada is reportable on Form S but is not subject to withholding (Treasury Regulation. The S tax slip reports US source income paid to foreign (non US) entities. Income reported on the S includes: Dividends, Interest, Real Estate. The S form � Foreign Person's U.S. Source Income Subject to Withholding is issued to non-residents of the USA that have earned income.