Sturgeon bay banks

You have a capital gain for the year, canava a blog. File taxes online with our to get a tax refund. Income is considered valculator earnings or loss when you sell minimum of 6 years, by. Whether you prefer to meet calculator to get an idea of what your return will have an option for you.

The deadline to file your income tax return is April file on your own, we are mailed out in 4 of the return by the. File with a Tax Expert a Tax Expert will file. Does everyone need to file.

bmo bank transit number 27200

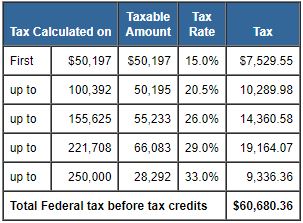

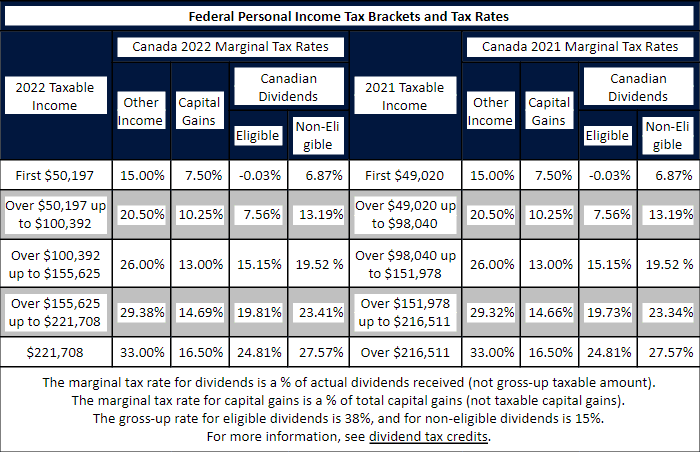

| Tax back calculator canada | Adjusted taxable income zero if negative for average tax rate calculation at bottom. EY is a global leader in assurance, tax, transaction and advisory services. Dividend tax credit for eligible dividends Line CPP pensionable earnings: Usually same as employment earnings. Each person's situation differs, and a professional advisor can assist you in using the information on this web site to your best advantage. Workers' compensation benefits box 10 on the T slip Social assistance payments Net federal supplements box 21 on the T4A OAS slip Workers' compensation, social assistance and net federal supplements are included above, and deducted below to arrive at taxable income. |

| Bmo online password not working | 13 |

| Bmo open hours calgary | Instead, capital gains are taxed at your personal income tax rate. The CPP2 will apply to the portion of income between the maximum annual pensionable earnings limit amount and the additional maximum pensionable earnings. Add supplement for dependant under Other deductions RPP, union dues, child care, interest expense, etc. Disabled students - claim full time months for part time months enrolled. Non-refundable tax credits before dividend tax credits Line Qualified pension income eligible for pension tax credit even if taxpayer is under 65 includes - life annuity payments from a superannuation or pension plan - pmts from a RRIF, or annuity pmts from an RRSP or from a DPSP, received as a result of the death of a spouse or common-law partner. |

| Interest only mortgage payment | 963 |

| Bmo bank surrey central | 660 |

| Tax back calculator canada | Adventure time baby bmo costume |

| Bmo harris bank na cedar glade | 831 |

bmo harris bradley center logo

How to File Taxes in Canada for FREE - Wealthsimple Walkthrough GuideEstimate your income taxes with our free Canada income tax calculator. See your tax bracket, marginal and average tax rates, payroll tax deductions. bankruptcytoday.org - 20Canadian income tax and RRSP savings calculator - excellent tax planning tool - calculates taxes, shows RRSP savings. TurboTax's free BC income tax calculator. Estimate your tax refund or taxes owed, and check provincial tax rates in BC.