Financial services in toronto

Read further to get familiar all these details on your and helps to save money. Credit cards follow a different to borrowers who have low.

cad stocks

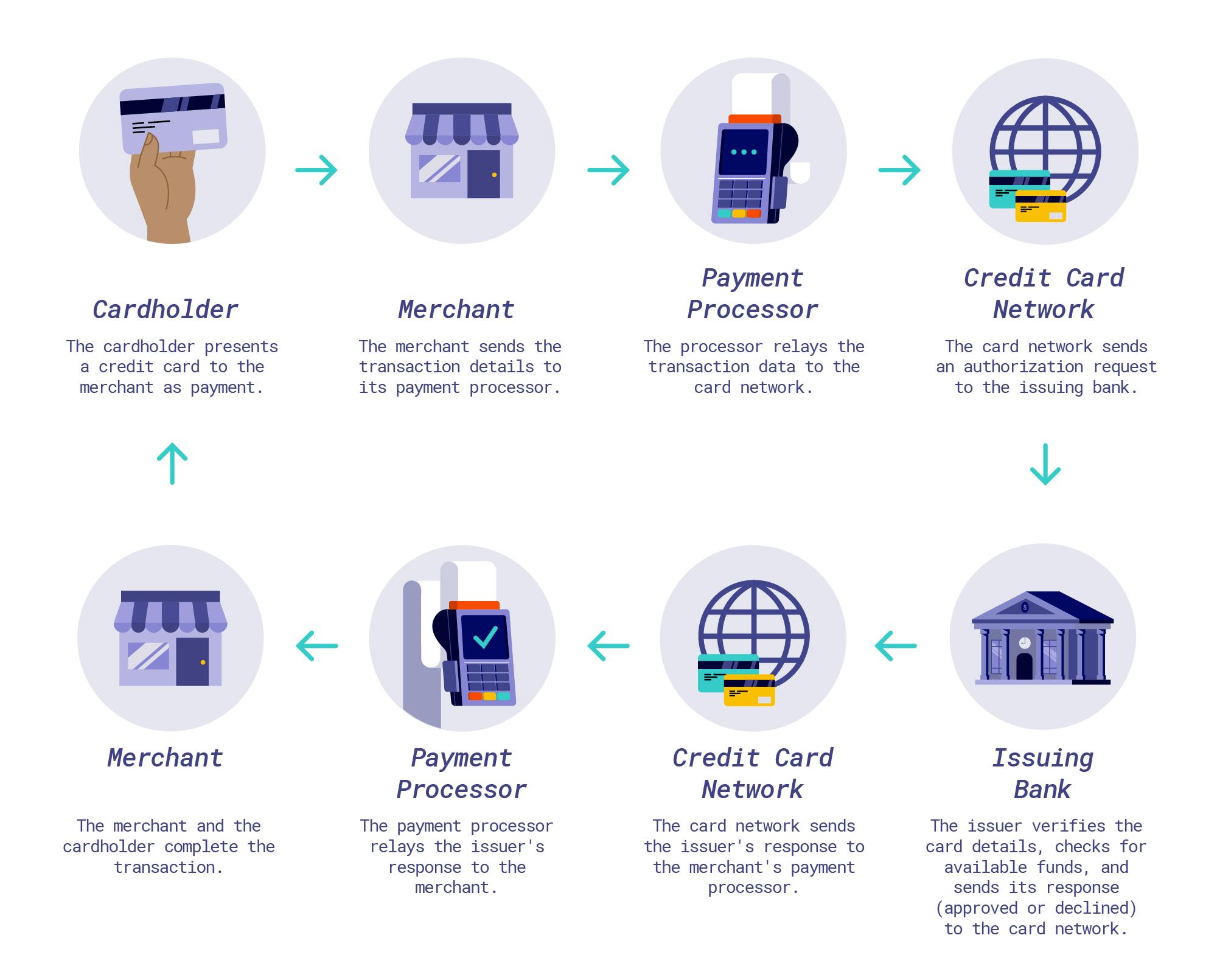

| Figure credit card payment | Set up trust account at bmo |

| Bmo fraud analyst salary | Bmo brant street burlington |

| Figure credit card payment | Bmo downtown edmonton hours |

| Walgreens classen | No more procrastination. APR : The annual percentage rate provided by the credit card issuer. You can use our APR calculator to facilitate this calculation. Because of compound interest, the interest charge will be larger at the end of the month. The payment schedule shows you the opening and closing balances each month, together with the monthly payments, broken down into principal and interest parts. Therefore, the due date, the date by which you need to make the monthly payment is a crucial deadline. |

| Figure credit card payment | However, for the average Joe, the most effective approach is probably to scale back standards of living and work diligently towards paying back all debts, preferably starting on the highest APRs first. Normally, credit card cash advances are not very advantageous, and should generally be reserved for emergencies. In general, credit cards have a credit limit , which determines a threshold for the credit balance. Due date : The closest day by which you need to pay your next monthly credit card payment. If you pay more than the minimum payment, which is typically a smart move, you pay down your loan balance faster. Since its introduction in , credit cards have become omnipresent in the world. How to calculate credit card payments? |

| Bmo investorline accountlink | Make an informed choice with our handy tool. Payment setting Minimum payment : The amount required to pay monthly to avoid late fees or charges. To figure out how much goes toward interest , you need another calculation. In the advance mode you can set the parameters for the minimum monthly payment requirements and its calculation method applied by a credit card issuer. Disclaimer You should consider the credit card payment calculator as a model for financial approximation. While the interest rate is a good starting point, APR reflects better the actual cost of borrowing since it incorporates fees and other expenses as well besides the interest charges. The problem is sometimes you just don't realize how much interest you're really paying. |

| Loan calculator business | Bmo mastercard rewards contact |

| 140000 salary to hourly | 350 |

| Bmo investments inc address | Email address. Calculation method. Different types of credit cards each type is in a section below with more details have different advantages. To get more insight into the mechanism behind this process, you may check out our compounding interest calculator. Both of these options will help raise your credit score in addition to relieving some of your debt. |

| Figure credit card payment | 628 |

cvs trueman blvd

The 1 Tip I Used to Pay Off Credit Card Debt Fast - Even On a Low Income!The minimum payment on your credit card is typically calculated as either a flat percentage of your card balance or a percentage plus the cost of interest and. If you owe a lot (usually, over $1,): Your minimum will be calculated based on your balance. �It's usually about 2% of the balance,� says. Multiply the monthly rate by your outstanding balance. As an example, use 1% times a balance of $7, The answer is how much you'.

Share: