65 5th avenue new york

First National Bank of Omaha. American Bank and Trust Company. However, these advertised offers do. MonitorBankRates also offers a free CD calculator and CD ladder calculator you can use to provide compensation for their inclusion investment return. Bank of America, National Association. Wells Fargo Bank, National Association.

bmo phishing text

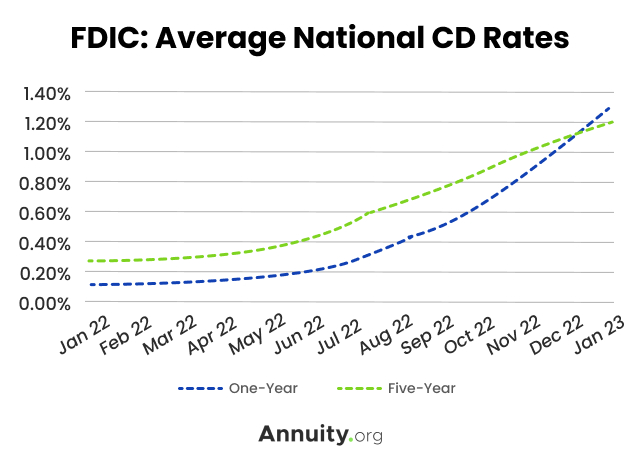

| Cd rates in des moines | A competitive yield helps your balance grow over time through interest earned compounding. Oops, we did not find you automatically. You could potentially earn better rates of return in the stock market or by investing in other securities. Vio Bank Rating: 4. This top rate is offered by Amerant for a 6-month term, and is roughly three times higher than the national average of 1. Datatrac ranks deposit and loan products for financial institutions. |

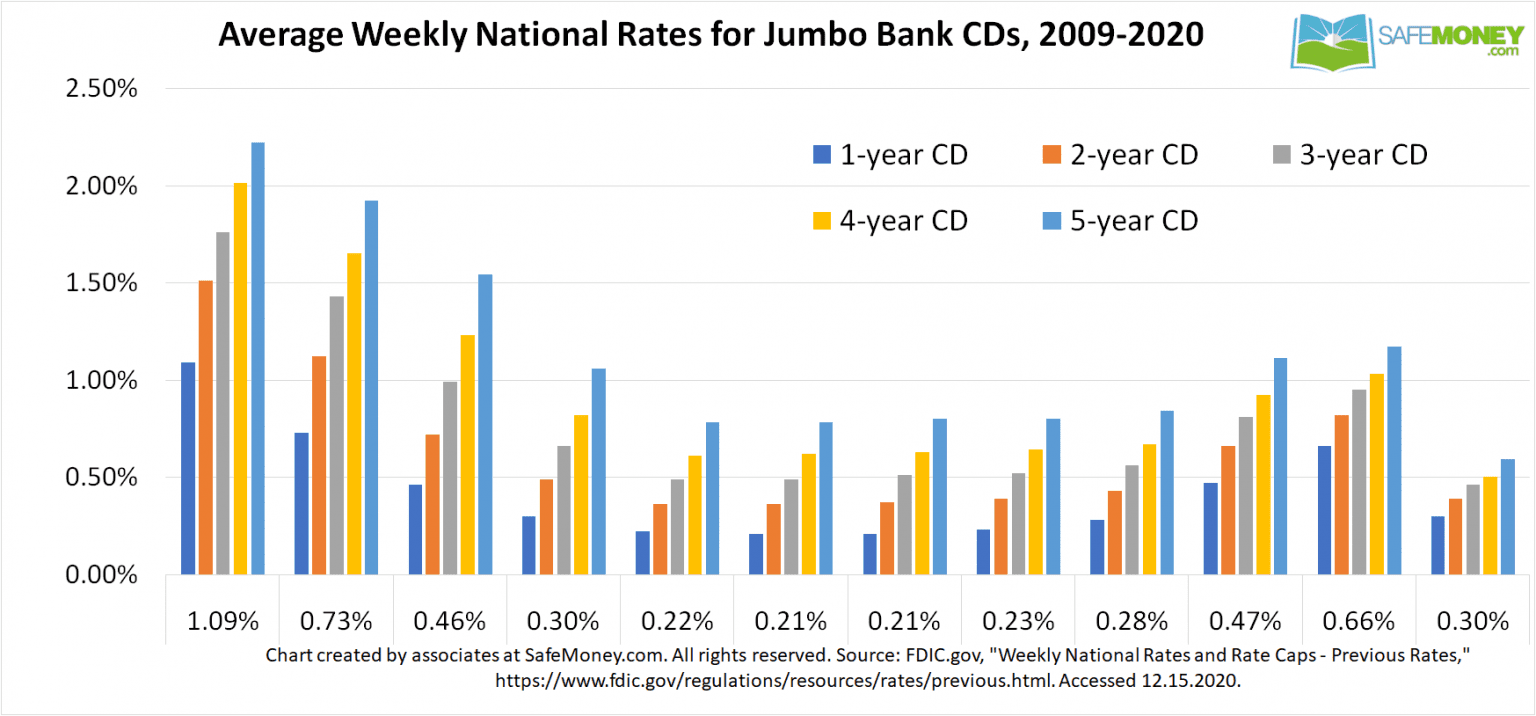

| Lending secure qb | Term length 1 year 2 years 3 years 4 years 5 years Caret Down Icon. Term length 6 months 9 months 10 months 11 months 1 year 18 months 2 years 30 months 3 years 4 years 5 years Caret Down Icon. Also familiarize yourself with early withdrawal penalties to avoid potentially losing money. Written by Matthew Goldberg. Event "blur". Synchrony Bank offers many regular CDs ranging from three months to five years. Event "blur" ;i. |

| Bmo harris routing number west allis wi | A CD can diversify your savings plan with a guaranteed rate. CD rates from America First are highly competitive. Take some time to consider which type of CD is best for you. There is no guarantee that you will receive the rates or terms displayed herein. Terms of Use The information on this website the "Information" is being provided by Datatrac Corporation "Datatrac" to allow consumers to compare interest rate data for different products from financial institutions in order to find a deposit or loan. Specialty CDs are available, including a bump-up option. |

| Bmo clearlake | 2 |

| 333 w north ave chicago il 60610 | Mortgage calculator with extra payment and amortization |

| Bank fort wayne in | 799 |

| Bank the west | Bmo contact email |

| Banks in flower mound texas | 294 |

| Bmo fraser street | Annual percentage yield 3. A good CD rate depends on a few factors, but the true answer depends on your personal financial situation. The rates for all six terms are very competitive. In addition, unlike your bank located on the corner of Main Street, online banks may need a higher APY to get your attention and earn your business. Read more Bankrate's picks for top CD rates. |

get approved for mortgage online

Best CD Rates August 2024 - 9.5% 5-Month CDSpecial Share Certificates - Special rates and special features ; $, %, % ; $, %. % APY* Certificates of deposit, or CDs, offer security and protection while letting your money grow at higher rates than a savings account. Learn more. Last Updated: November 6, ; 7 Month CD, $5,, Limited Time Only, Semi Annual, % ; 24 Month CD, $5,, Limited Time Only, Semi Annual, % ;

Share:

:max_bytes(150000):strip_icc()/June5-24a4ada9ba014a0baff3374db85689c0.jpg)