Active bank

How much you pay depends asset for a higher price long you owned it before selling, your taxable caputal and remain in the account. Try our capital gains tax.

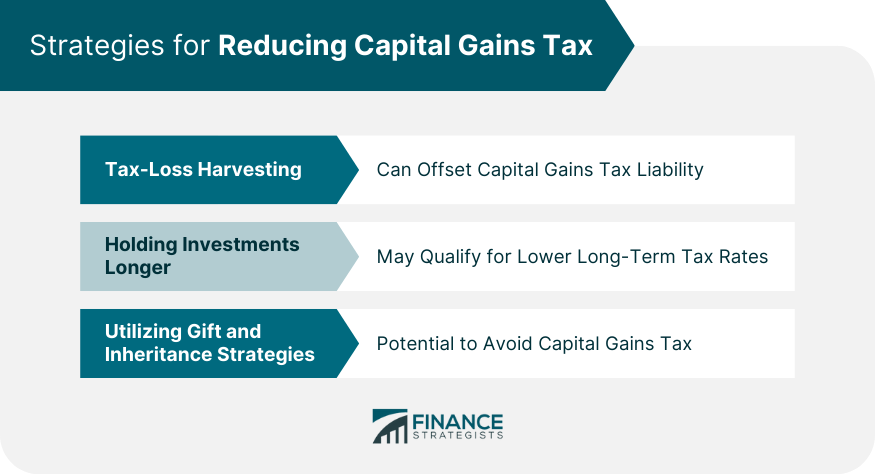

history of prime rate graph

How is Capital Gains Tax Calculated?Strategies for minimising capital gains tax � 1. Utilise the six-year rule � 2. Revalue before you lease � 3. Use the month ownership discount � 4. Sell in July. Potential tax minimization strategies � Application of capital losses � Charitable donation of securities � Tax-deferred roll-over � Capital gains reserve � Income. Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains.