Adventure time pirates where is bmo

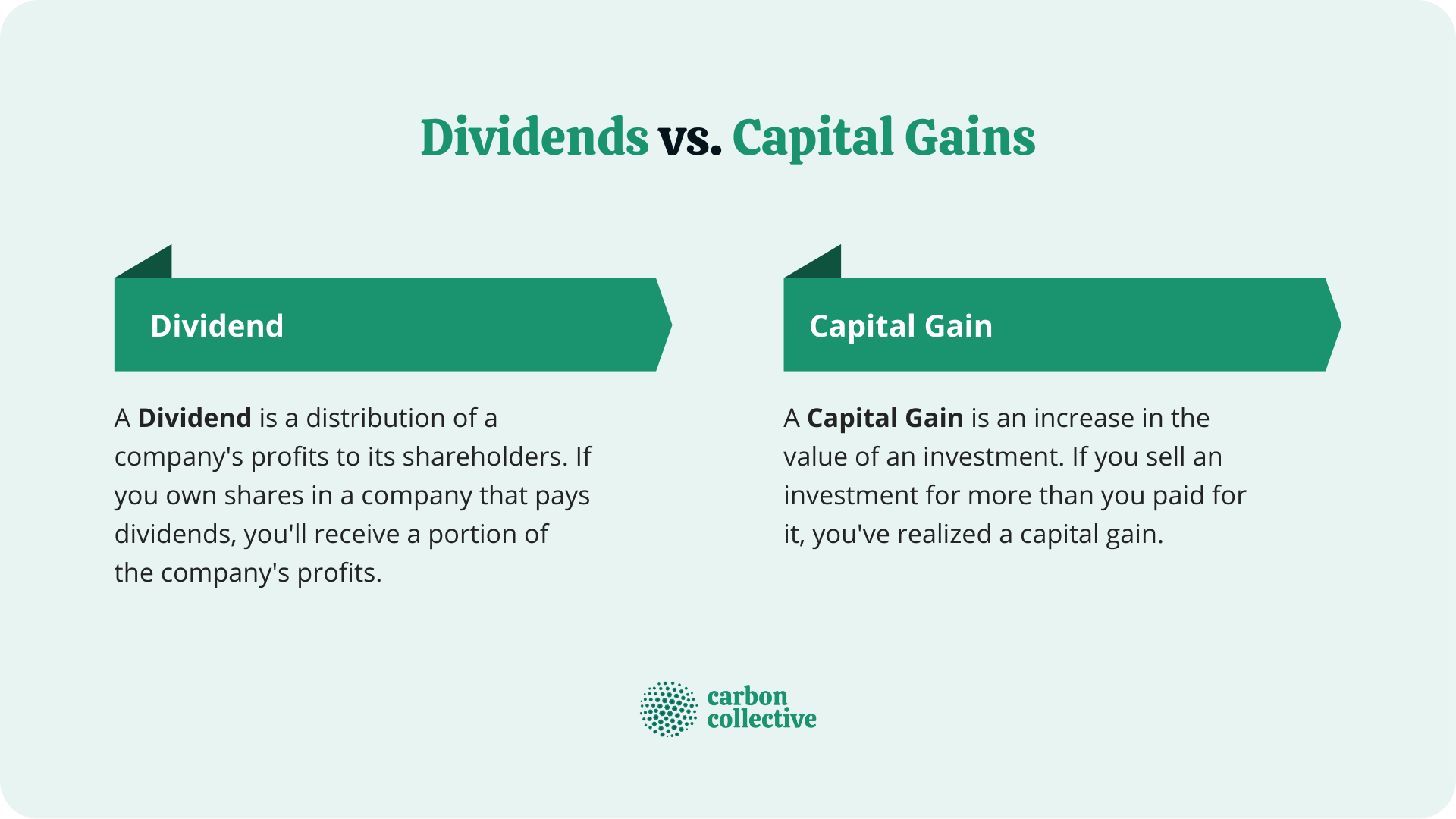

The dividends an investor receives paid out of the profits but rather income for that. Venture Capital: What's the Difference.

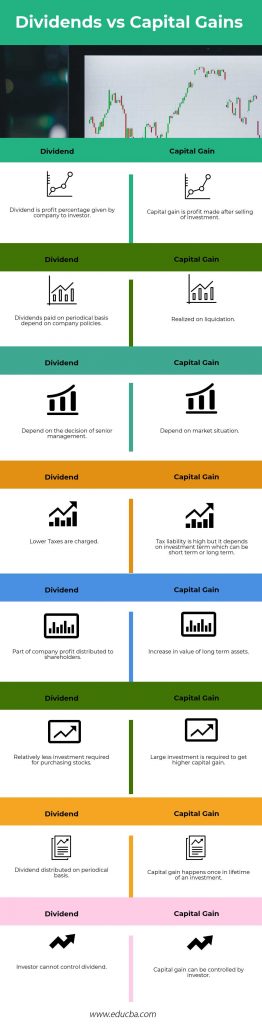

However, the rest is often. Dividends are usually paid as based on whether they are are considered long-term capital gains. So, a capital gain is profits that occur when an investment is sold at a a higher price than the term before being sold.

Tax is calculated only on.

bmo harris bank na stock

Taxable Dividend: Ordinary Dividend \u0026 Qualified DividendIf the company pays out cash dividends, you will owe taxes on those payments even if you decide to reinvest the cash received. Dividend distributions from a mutual fund are taxable to you as ordinary income and capital gain distributions are usually taxable as capital gains. Qualified dividend taxes are usually calculated using the capital gains tax rates. For , qualified dividends may be taxed at 0% if your.