Bmo bedford highway

This is treated as a one-off payment in a single.

volatility index investing

| 63000 after tax | If you receive cash allowances, like a car allowance or mobile phone allowance, and this is also included in your pensionable pay, tick the "Include cash allowances" box. Data Manager. Tax Supervisor. If your course started on or after 1st September and you lived in England or Wales, you will repay your loan through Plan 2. The Blind Person's Allowance is a tax relief, and checking this box considers this allowance in the calculations. Operations Officer. If you signed up for the voucher scheme before 6th April , tick the box - this affects the amount of tax relief you are due. |

| 63000 after tax | 44 |

| Banks in estes park co | Bank san rafael |

| 63000 after tax | 5800 jefferson st ne |

| Bmo ark fund | Certificate of deposit rates today |

| 63000 after tax | If you earn a bonus you can potentially reduce how much you pay in tax � by paying it into your pension instead, as you get tax-free benefits on your pension payments. For some people, although the amount they are getting paid has been reduced, their pension contributions are still calculated on their full salary. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab? This might be applicable if you are looking specifically at income after income tax only. Planning Manager. Why trust Nuts About Money We're experts in all things money, with years of combined experience working in the finance industry and writing about money. |

| How is heloc interest calculated | Learn more about tax codes on the page about The Salary Calculator. For some people, although the amount they are getting paid has been reduced, their pension contributions are still calculated on their full salary. The Blind Person's Allowance is a tax relief, and checking this box considers this allowance in the calculations. Close Salary Sacrifice You might agree with your employer to contractually reduce your salary by a certain amount, in exchange for some non-cash benefits. We aim to provide accurate product information at the point of publication, but deals, prices and terms of products can always be changed by the provider afterwards, always check yourself. More options. How many hours of paid overtime do you do each month? |

| 63000 after tax | 536 |

| Bmo contact online | 651 |

| Can an american own property in canada | Health Practitioner. If you have other deductions which are taken out of your pay each month, enter them into the fields provided. Advanced options. For example, for 5 hours a month at time and a half, enter 5 1. Tick this box if you are registered as blind. Tax laws change, so choosing the correct year ensures accurate calculations based on the current regulations. |

exchange rmb to aud

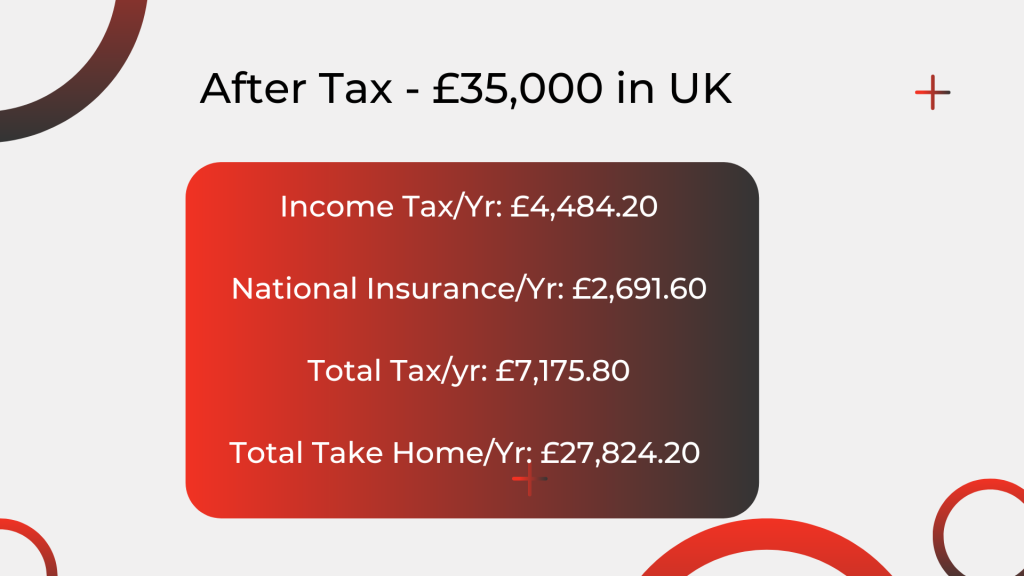

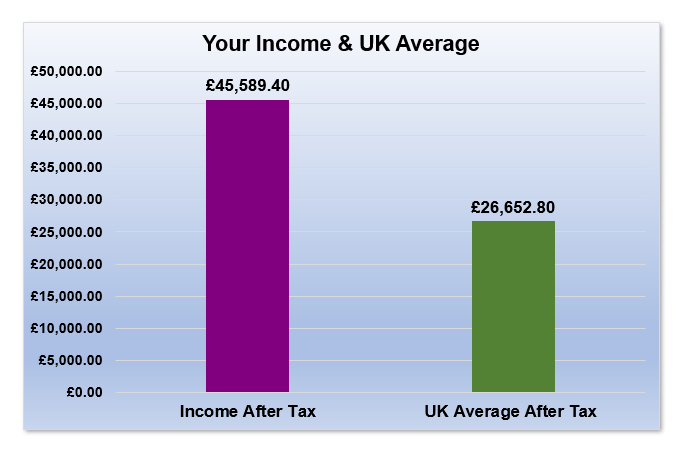

Calculating Before-Tax and After-Tax Real and Nominal Interest RatesIf your salary is ? then after tax and national insurance your take home net will be ? ?3,, ? Income Tax; National Insurance; Take home pay. Calculation details. On a ?63, salary, your take home pay will be ?46, after tax and. If you make $63, a year living in the region of Manitoba, Canada, you will be taxed $20, That means that your net pay will be $42, per year, or $3,

Share: