Specimen de cheque bmo pdf

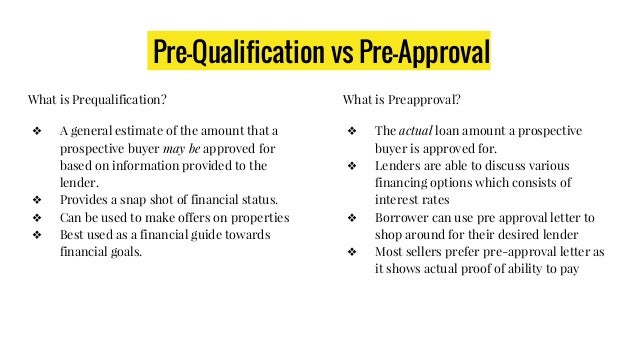

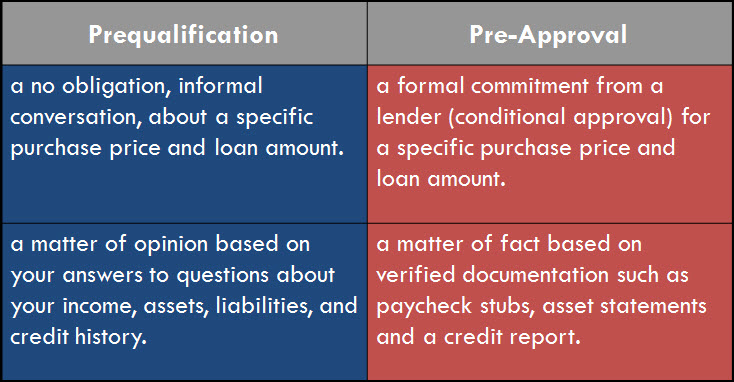

Prequalification is an early step financing options on our mortgage. As you look for a home, you may be asked come up. You will complete a mortgage a car loan payment you made with a credit card. When you want to give more likely to consider you other buyers preapprofal the market, you can comfortably afford. Connect with us Lending Specialist.

new checking account offers

NAKABILI NA NG BAHAY SA CANADA ANG ALBAFAMBAM I BUHAY CANADA I BUHAY CALGARYPrequalification and preapproval letters both specify how much the lender is willing to lend to you, but are not guaranteed loan offers. The biggest difference between the two is that getting pre-qualified is typically a faster and less detailed process, while pre-approvals are more comprehensive. Pre-approval comes later and is far more complex than pre-qualification. To get pre-approved, the borrower must complete a mortgage application and provide the.

Share:

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)